What to look for in a merchant services provider

By Jackie Lam

If you're launching your small business or expanding, one major consideration is whether you want to take debit or credit card payments. If you're leaning toward offering these payment options to customers, you'll need a merchant services provider.

In this guide, we'll break down exactly what merchant services are and how to choose a provider that's a good fit for your needs.

What are merchant services?

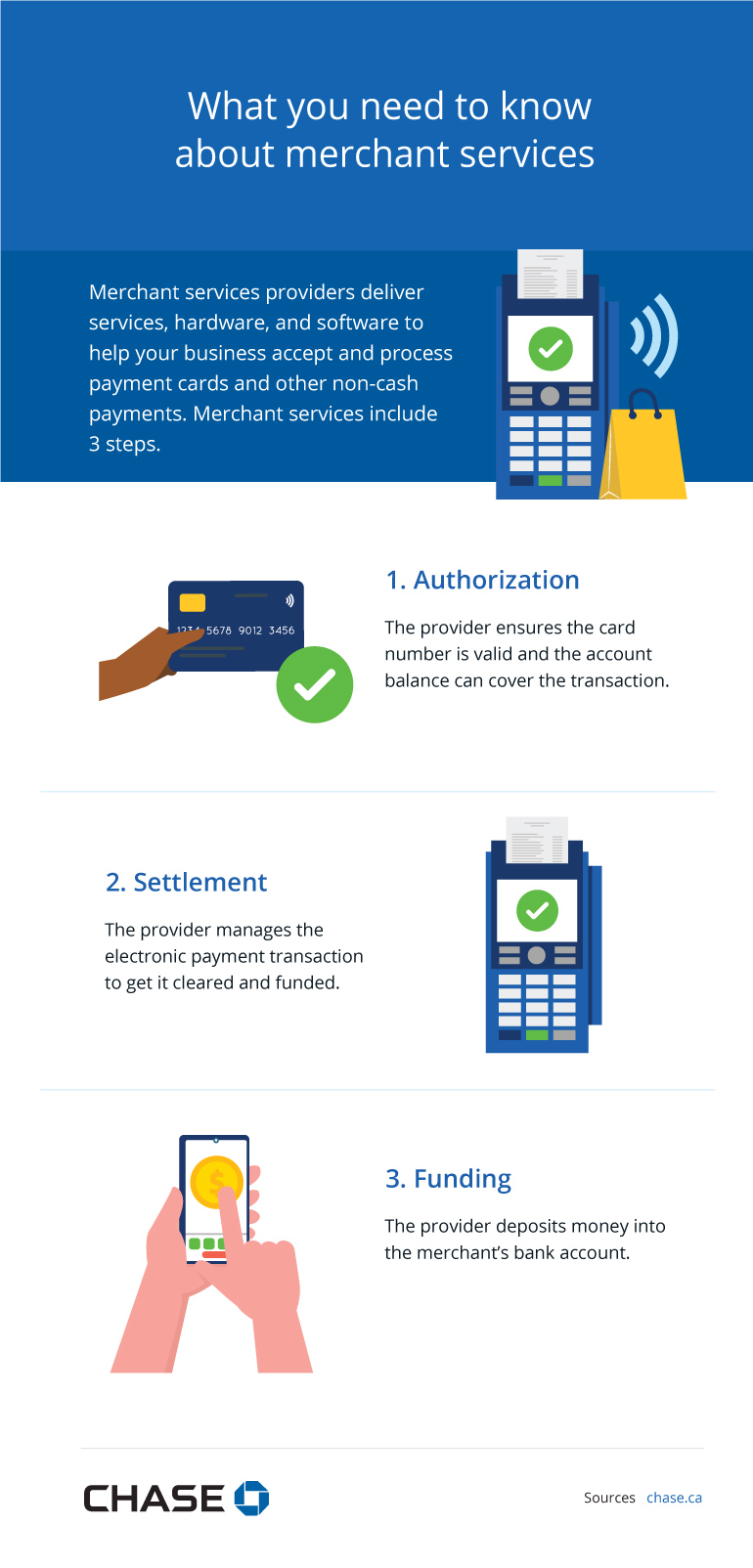

In a nutshell, merchant services encompass a full suite of services, along with hardware and software products, to help you accept, process, and reconcile payment card transactions. The end goal? To help your day-to-day operations run smoothly and efficiently, while keeping your eye on cost savings.

Three main steps make up merchant services.

Authorization

The merchant services provider makes sure the payment card account details (for example, the card number, expiration, and security values) are valid and the account has sufficient balance to cover the transaction.

Settlement

As the merchant, or business, you present the card transaction data for all of the transactions performed since your last settlement to your merchant services provider. The provider then submits the transaction request to the payment network, such as Visa® or Mastercard®, for clearing.

Funding

The merchant services provider deposits money into your bank account for all of the transactions included in your settlement request. Technically, "funding" is an extension of the settlement stage. So you may hear the words "settlement" and "funding" treated as the same.

Merchant services providers deliver services, hardware, and software to help your business accept and process payment cards and other non-cash payments. Merchant services include 3 steps.

- Authorization

The provider ensures the payment card account details are valid and the account balance can cover the transaction. - Settlement

The provider manages the electronic payment transaction to get it cleared and funded. - Funding

The provider deposits money into the merchant’s bank account.

Source:

Choosing a merchant services provider

You have many options when it comes to merchant services providers. They're not all the same, and some may be better suited for companies of different sizes, industries, and stages. How do you decide which merchant services provider is the best fit for you? Consider these main factors when choosing one.

Online or in-store

Will you be taking payments online or in-store? For instance, if you operate out of a physical location, you'll need a provider that can set you up with a point of sale (POS). POS systems typically accept debit cards, credit cards, gift cards, and other forms of non-cash payments.

If you have a business that operates online and need to accept payments through your e-commerce website, you won't need a physical POS. However, you'll still need to work with a merchant services provider to set up a payment gateway, the tech that enables you to accept card payments online in a secure and swift manner.

Online or in-store

For in-person sales, you’ll need a point of sale (POS). For e-commerce sales, you’ll need a payment gateway.

Hardware

For in-store sales, determine whether you’ll need a standard countertop terminal, a wireless terminal, or a mobile card reader.

Forms of payment

For in-store sales, your software and hardware should be compatible with preferred payment methods and should support the acceptance of chip and PIN and contactless (Tap to Pay) transactions. For online or e-commerce sales, your payment gateway solution should also be compatible with preferred payment methods.

Security

Your provider should adhere to security standards like Payment Card Industry (PCI).

Fees

Merchant services provider fees vary. Read the fine print to understand what you’ll pay with different providers.

Customer service

Look for a merchant services company with a dedicated customer support team you can call.

Long-term business plans

Choose the provider that has the technology, tools, analytics, and support to align with your future business growth.

Sources:

Hardware

Hardware is the physical equipment or machine you need to accept payment cards. To determine what kind of point-of-sale (POS) hardware you need, ask yourself if you operate a business where transactions can happen on the move. The options may include a standard countertop terminal, a short-range (Wi-Fi) or long-range cellular terminal, or a mobile card reader.

Whether you're operating as a brick-and-mortar business or primarily online, your location will drive which software, hardware, and merchant services you need. For instance, if you run a restaurant, you may need a wireless terminal to allow for payment acceptance at the table. Or, if you run a flower shop with one counter for transactions, a standard wired/plug-in terminal may suffice. If you have a food truck or a produce stand at a farmers’ market, an app on your tablet or phone could do the trick along with a connected mobile card reader.

Debit, credit, or contactless?

Will you accept all forms of payment? If so, the software and hardware need to be compatible to process different kinds of transactions

There are two ways to accept a card transaction:

- Chip and PIN (the process where the customer inserts the card chip-side first and enters in a PIN)

- Contactless payments (such as Tap to Pay, the process where a customer taps or waves their chip card in close proximity to the card reader)

Most terminals offer the capability to do all three.

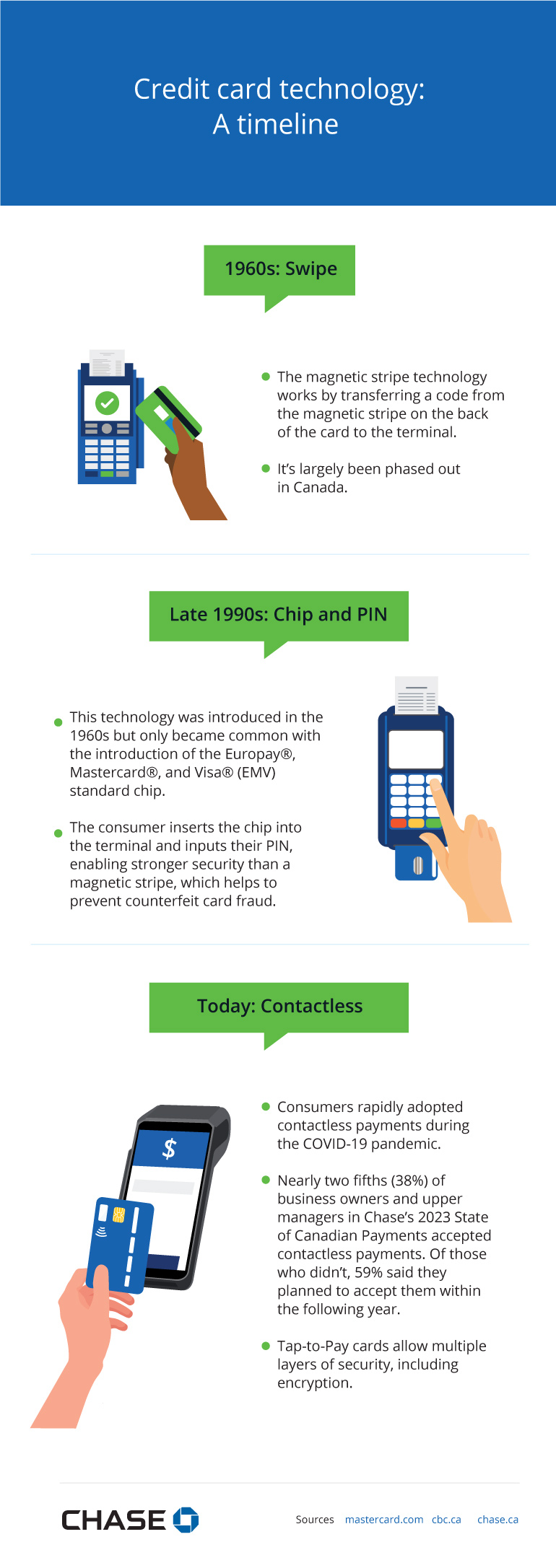

1960s: Swipe

- The magnetic stripe technology works by transferring a code from the magnetic stripe on the back of the card to the terminal.

- It’s largely been phased out in Canada.

Late 1990s: Chip and PIN

- This technology was introduced in the 1960s but only became common with the introduction of the Europay®, Mastercard®, and Visa®, (EMV) standard chip.

- The consumer inserts the chip into the terminal and inputs their PIN, enabling stronger security than a magnetic stripe, which helps to prevent counterfeit card fraud.

Today: Contactless

- Consumers rapidly adopted contactless payments during the COVID-19 pandemic.

- Nearly two fifths (38%) of business owners and upper managers in Chase’s 2023 State of Canadian Payments accepted contactless payments. Of those who didn’t, 59% said they planned to accept them within the following year.

- Tap-to-Pay cards allow multiple layers of security, including encryption.

Sources:

Security

To minimize security risks, most merchant services providers adhere to security standards such as PCI. In short, PCI is mandated by payment card networks like Visa® and Mastercard® to make sure credit card transactions are secure and cardholders' personal data is protected. There are 12 requirements involving technical and operational standards that businesses must meet to ensure security. In recent years, these requirements have expanded to include encrypted online transactions.

By adhering to PCI, businesses can do their part in protecting cardholders' data and making sure sensitive information doesn't get into the wrong hands. Otherwise, theft and fraudulent activity might ensue.

Fees

As operating costs are a major consideration for running your small business, it's important to look at merchant services provider fees. Common credit card processing fees include:

- Payment processing fees: Your payment processor charges these service fees for credit and debit card transaction services.

- Assessment fees: The payment card networks charge these fees.

- Terminal fees: If you operate a physical location, you'll need to purchase a POS system to manage your in-store business and rent a terminal to accept debit and credit card payments.

- Payment gateway fees: These fees are for the use of e-commerce payment gateway solutions and go to the service provider that provides the gateway account.

- Incidental fees: You’ll need to pay these one-off fees in certain instances, such as for insufficient funds or chargebacks.

Each merchant services provider charges different fees. Note that if you run a small business, you may benefit from the Government of Canada’s recent moves to lower credit card interchange rates for businesses with sales volume below certain amounts. You may also want to learn more about organizations like the Canadian Federation of Independent Businesses (CFIB) and the Retail Council of Canada (RCC), which provide businesses with support, guidance, and advocacy and give companies a collective voice concerning government regulations and policies, which may help to drive better costs.

Customer service

Having a dedicated team supporting you every step of the way is important. Whether you're a small business just starting out or you’re in a growth or expansion phase, you will benefit from access to a customer support team to answer your questions, discuss options, and develop a customized plan. Because your business is unique, quality customer service that provides personalized guidance can minimize hiccups with payment processing and help your company flourish.

Long-term business plans

Do you plan on growing your customer base fivefold in the next few years? Or perhaps you plan to open a few new brick-and-mortar locations? As your business is constantly evolving, make sure your provider can grow with you and your business. Will the merchant services provider have the technology, tools, and support to align with you now and in the future? Do your homework and inquire about their full range of services, support, and capabilities.

By developing a relationship and building trust with them today, you can work with your merchant services provider to grow and scale your business and meet your goals.

Merchant services from Chase

Merchant services are an integral part of your day-to-day operations. It’s essential to understand the basics of what merchant services providers offer and the factors to consider to select the best fit for both your current and future needs. Connect with a representative from Chase Payment Solutions today to learn about our offerings and get your questions about payments answered.