Grants and resources for Canadian small businesses

By Kathryn Casna

While many Canadian small businesses rely on private capital to turn or keep the lights on, grants are also a great option for many entrepreneurs. Most grants are highly competitive, but when you find the right one for your business and you know how to apply, they can be an incredible help.

Every small business in Canada is facing obstacles to their growth. A small business grant could help you start or grow your business even in an unstable economic environment, temper the impact of those obstacles, and push forward and succeed.

Obstacles for Canadian small businesses in 2024

Many challenges facing Canadian small businesses today aren’t new, but changes in market behaviours and demands, high inflation, record employment rates, and other conditions are exacerbating them.

Rising cost of inputs

While the rate of inflation has slowed compared to recent years, prices overall remain elevated. Gas prices, for instance, rose at a faster pace this past July (up 1.9%) compared to the month before, so if a business relies on physical products of any kind, it likely experienced higher costs for materials and delivery.

Beyond inflation, Canadian businesses face rising labour costs, which means even completely digital businesses (such as SaaS companies or consulting agencies) could see lower profit margins. Additionally, 4 in 10 businesses surveyed in April 2024 anticipated rising interest rates and debt costs to be an obstacle in the coming months.

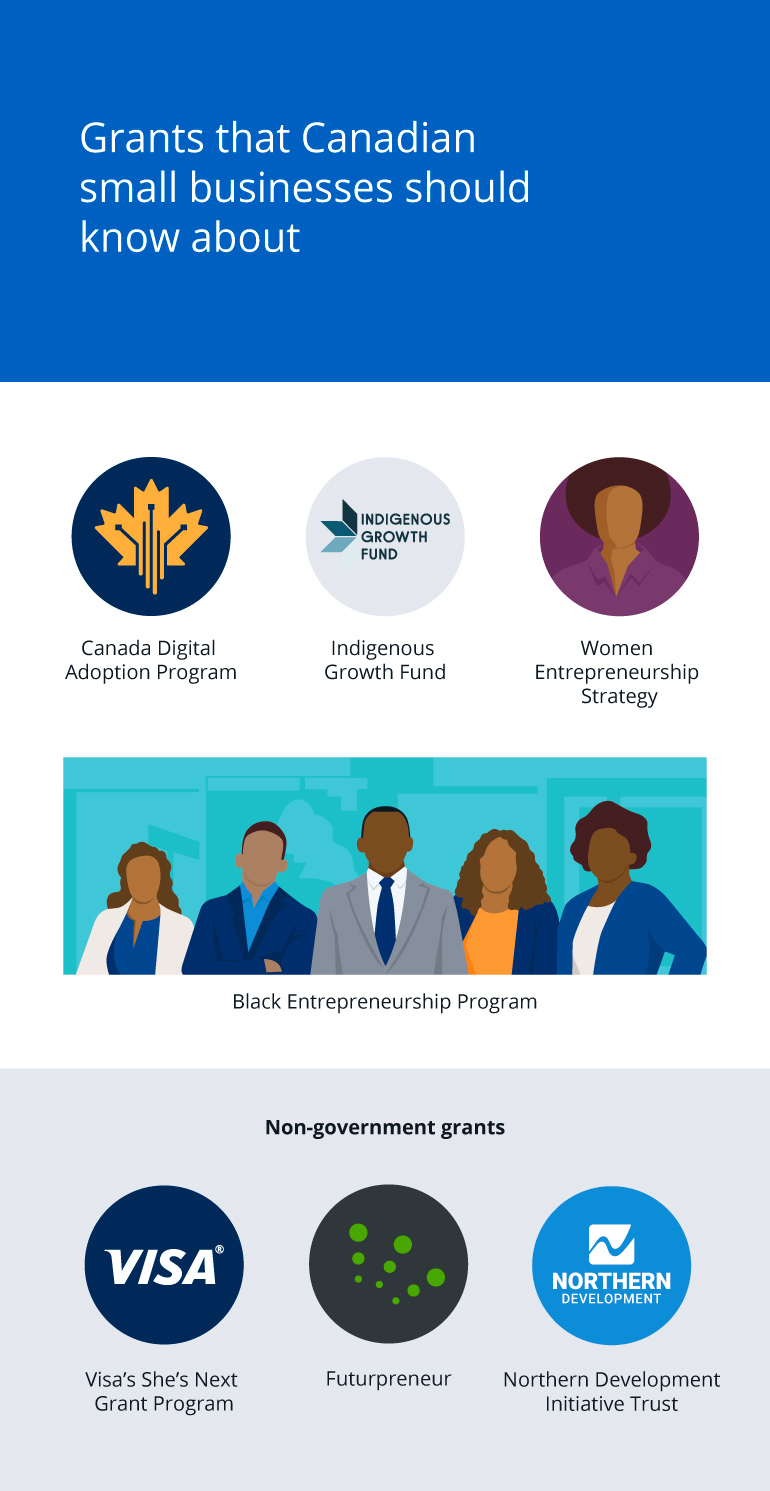

- Canada Digital Adoption Program (CDAP) (2022, July 22). Government of Canada.

- Indigenous Growth Fund. NACCA National Aboriginal Capital Corporations Association.

- Women Entrepreneurship Strategy (2023, March 8). Government of Canada.

- Black Entrepreneurship Program (2021, May 31). Government of Canada.

Non-government grants

Recruiting and retaining skilled employees

According to a 2024 report, salary is the biggest motivator for job seekers, with 60% of respondents reporting it as the number one reason they want a new job. With employees on the hunt for higher wages to keep up with rising costs, businesses need to find ways to stay attractive to current and prospective talent, starting with salary, benefits, and perks.

Fluctuations in consumer demand

Between the rising costs of goods and a lot of job changing, both consumers and businesses may face unpredictable budgets that lead to fluctuations in demand. Whether your business is primarily B2C or B2B, you could see unexpected peaks and valleys in your sales or profit margins. In Q2 of 2024, nearly one third of small businesses expected to see a decrease in their profitability over the following three months.

Cash flow, debt management, and financing

Cash flow, debt management, and financing are constant concerns for small businesses, and the current economic climate could make managing the budget for a small business tougher. In Q2 of 2024, 7.7% of small businesses that didn't plan to apply for debt financing said they couldn't take on more debt. Meanwhile, high interest rates mean many loans are growing more expensive. A grant may offer your business a lifeline outside of traditional venture capital.

Other obstacles

Other top concerns for Canadian small businesses include:

- Corporate tax rates: Right now, small businesses have a reduced federal tax rate of 9% on their first $500,000 of taxable income. This is compared to the 15% general federal corporate tax rate. “A business no longer has access to this lower rate once its level of capital employed in Canada reaches $15 million.”

- Government regulations: Compliance measures can add time to production and labour costs to your bottom line.

Grant opportunities and other resources

No matter what your business offers, your sales, profitability, and cash flow may be affected by the challenges in this economy. If you’re feeling or anticipating any of the above challenges, now is a great time to apply for a grant or look into other resources.

Here are a few grants and resources that are available to Canadian small businesses.

Canada Digital Adoption Program

Modelled after the Digital Main Street programs in Ontario and Toronto, The Canada Digital Adoption Program is a $4 billion federal fund that helps small and medium businesses start or expand their digital operations.

Who it’s for:

- Small businesses may be eligible for a Grow Your Business Online micro-grant (up to $2,400).

- Small and medium businesses may be eligible for a Boost Your Business Technology grant to hire a digital advisor.

Obstacles addressed:

- Managing labour shortages, recruiting, and retaining talent

- Addressing government regulations, such as network security, privacy, and compliance efforts

- Keeping pace with competitors

How you can spend it:

- Work with a digital advisor.

- Set up a website.

- Outsource search engine optimization (SEO) or social media marketing efforts.

- Cover e-commerce fees.

- Hire young Canadians.

- Fund network security measures.

- While every grant is different, many applications ask for the same basic information.

- That means you could apply for more than one grant without doubling your effort.

Gather the following information to help you prepare for just about any grant application:

General application preparation:

- Business description: Keep it simple and avoid marketing jargon.

- How many employees you have.

- Your last three years of financial statements, or as long as you’ve been in business, if less than that

- Incorporation documents, if any

Funding for a specific project:

- A project description, including any metrics or data you can include

- A detailed breakdown of expected expenses

- Any potential risks

- Any economic benefits for Canada, such as jobs created or communities served

Black Entrepreneurship Program

The Black Entrepreneurship Program is an investment of up to $265 million designed to be spent over four years. The program started by funding research into how to best help Black-owned businesses and training and mentorship for Black entrepreneurs. Additionally, the Black Entrepreneurship Loan Fund has loans of up to $250,000 and a pilot program for micro-loans of $10,000 to $25,000.

Who it’s for:

- Start-ups and for-profit businesses led by greater than 51% Black, legal Canadian residents who are 18 years old or older.

Obstacles addressed:

- Cost of inputs

- Cash flow, debt management, and financing

- Keeping pace with competitors

How you can spend it:

- Capital investments, such as equipment and property improvement

- Working capital, such as inventory, payroll, rent, and other overhead

- Short-term receivable funding, such as financing upfront costs for work that’s billable later

Indigenous Growth Fund

The Indigenous Growth Fund is an investment fund that raised more than $150 million in capital to invest in Indigenous-owned Canadian businesses. Funds will be distributed by local financial institutions and organizations.

Who it’s for:

- Small and medium Indigenous businesses

Obstacles addressed:

- Rising cost of inputs

- Labour shortages, recruiting, and retaining talent

- Fluctuations in consumer demand

- Cash flow, managing debt, and financing

- Taxes and government regulations

- Keeping up with competitors

How you can spend it:

- Varies between lending institutions

Women Entrepreneurship Strategy

The Women Entrepreneurship Strategy program provides more than $6 billion to help women-owned businesses and female entrepreneurs with financing, networking, and finding talent. The program includes funding for research about women entrepreneurship, support and mentoring networks, loans, and investment capital. This program is in the early stages, and funding will be available soon.

Who it’s for:

- For-profit businesses run by women looking for loans of up to $50,000

- Not-for-profit organizations that help women entrepreneurs

Obstacles addressed:

- Rising cost of inputs

- Labour shortages, recruiting, and retaining talent

- Fluctuations in consumer demand

- Cash flow, managing debt, and financing

- Taxes and government regulations

- Keeping up with competitors

How you can spend it:

- Restrictions for this program are still being decided.

Non-government grants

Not all grants for Canadian small businesses come from the government. Private foundations and non-profit organizations also provide grants. Like government sources, these grants often serve specific types of businesses or businesses in certain regions.

- Canadian women entrepreneurs and businesses can also apply for funding through VisaⓇ’s She’s Next Grant Program.

- Younger entrepreneurs who are 18 to 39 years old can apply for mentoring and financing through Futurpreneur.

- Businesses in central and northern British Columbia can apply for grants through the Northern Development Initiative Trust.

There are many great grant opportunities for small businesses in Canada.

Unfortunately, there’s also a rise in scams and fake grants.

To spot a scam, look out for:

- Upfront application fees and personal information

- A URL that doesn’t look correct, or isn’t secure (https), which may indicate a phishing scheme

- Application fees (there are no fees for government grants, and certain provinces ban grant application fees)

- Guaranteed loans

- Instant approvals

- A larger grant amount for a larger fee

Requests for:

- An email money transfer

- Money service business

- Pre-paid credit cards

Before you apply

Grant applications can be time-consuming, and for many small businesses, every minute of productivity counts. Make the most of your time by applying only for grants that are the right fit and knowing what to expect during the application process.

Finding the right fit

Often, grants have highly specific selection criteria, and many businesses compete for a share of the same pool of funds. Instead of applying for a large number of grants, find a few that fit your business well and focus on those applications.

A good way to find out if a grant is a good fit for your business is to look up which businesses the grant has already approved—information which is publicly available. If businesses like yours have received funding, there’s a good chance yours could too.

Furthermore, read the requirements of the grant carefully so you know what you can use it for and what the funding limits are. You’ll often need to fund at least 50% of a project yourself; the grant won’t cover everything. Also, be aware that many grants require continued reporting on the impact the funds have had on your business and your community. Make sure you can fulfill these requirements before applying.

Applying for a grant

While every grant is different, many applications ask for the same basic information. That means you could apply for more than one grant without doubling your effort. Gathering the following information can help you prepare for just about any grant application.

General application preparation:

- Business description: Keep it simple and avoid marketing jargon.

- How many employees you have

- Your last three years of financial statements, or as long as you’ve been in business, if less than that

- Incorporation documents, if any

Funding for a specific project:

- A project description, including any metrics or data you can include

- A detailed breakdown of expected expenses

- Any potential risks

- Any economic benefits for Canada, such as jobs created or communities served

Finally, be succinct. Application reviewers are legally bound to evaluate all applications equally, using the same information from each business. If you have more information that would help your case, add a note and offer to provide a full description upon request.

Avoid scams

There are many great grant opportunities for small businesses in Canada. Unfortunately, you may encounter scams and fake grants. These scams typically ask for upfront application fees and personal information, and they use websites that look legitimate — but then they steal your cash or identity. Always double-check the URL of any grant website and call the organization to confirm it if necessary. Sometimes, a quick Google search can reveal whether a grant is legitimate or should be avoided.

Other red flags include:

- Application fees (for government grants and certain provinces that ban them)

- Guaranteed loans

- Instant approvals

- A larger grant amount for a larger fee

- Requests for an email money transfer, money service business, or prepaid credit card

Conclusion

Current economic obstacles make starting and growing a small business in Canada a challenge. Luckily, there are grants and resources that can help.

If you find a grant that’s a great fit for your business, read the fine print carefully and follow all the application instructions. With a bit of work upfront and some reporting work later, you may secure the funding your company needs to face these obstacles head-on and build a successful future.