AI in payment processing: current trends & future state

By Jackie Lam

Artificial intelligence (AI) is no longer a novelty in the digital landscape — it’s deeply embedded across industries and has transformed how we operate and communicate.

Whether it’s to check the tone of an email, navigate a streaming platform, or learn more about a product or service, chances are, you use AI and its technologies in your day-to-day life.

There's a good reason Canada's AI ecosystems continue to grow. In 2023, for instance, the Government of Quebec allocated $100 million over five years to fund AI organizations and research centres plus an additional $40 million to the Pan-Canadian Artificial Intelligence Strategy. And in 2024, Google Canada announced they would fund new grants to back AI research in several key areas, including sustainability and the responsible development of AI.

In the fintech space, AI and machine learning power everything from robo-advising to digital trading and open banking. So what does AI in payments look like, and what can small businesses anticipate in the near future? Let's take a look.

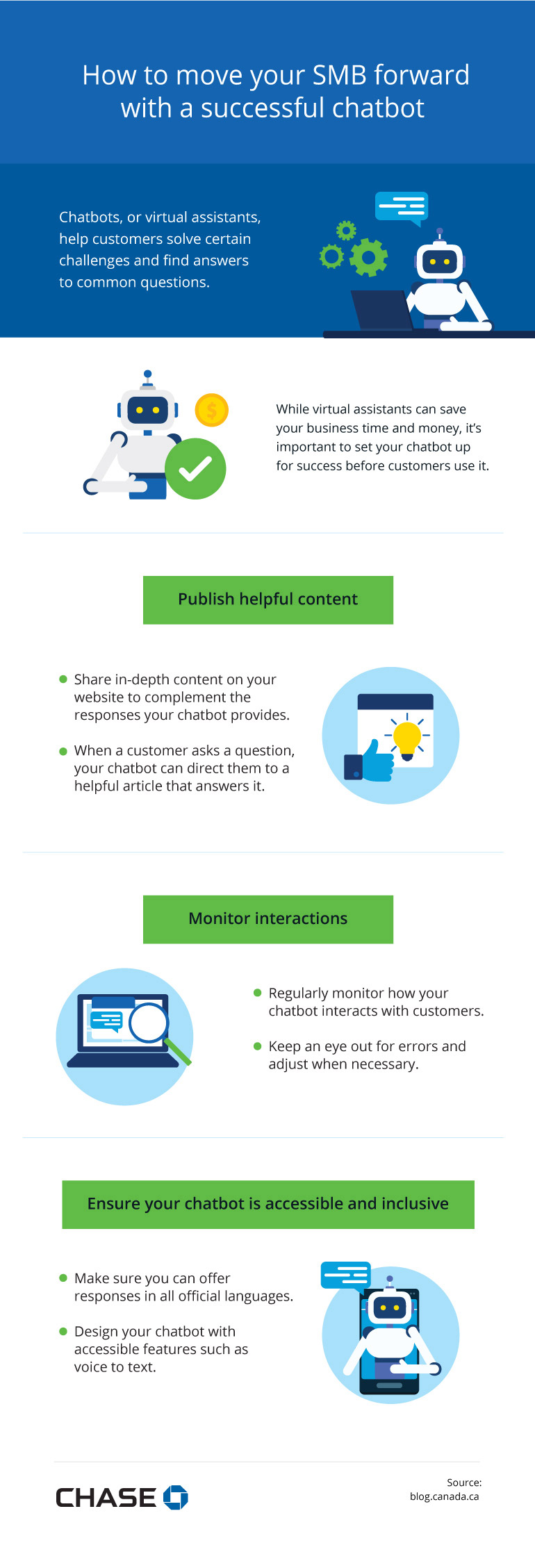

Chatbots, or virtual assistants, help customers solve certain challenges and find answers to common questions.

While virtual assistants can save your business time and money, it’s important to set your chatbot up for success before customers use it.

Publish helpful content

- Share in-depth content on your website to complement the responses your chatbot provides.

- When a customer asks a question, your chatbot can direct them to a helpful article that answers it.

Monitor interactions

- Regularly monitor how your chatbot interacts with customers.

- Keep an eye out for errors and adjust when necessary.

Ensure your chatbot is accessible and inclusive

- Make sure you can offer responses in all official languages.

- Design your chatbot with accessible features such as voice to text.

Source:

How is AI currently used in payments?

Industry-leading payments providers can use AI to streamline payment processing, improve customer service, and enhance fraud detection. In turn, innovation in AI-powered technologies enhances features and adds new offerings in the space, which benefit both merchants and customers. Here's how AI impacts the payment processing landscape.

Virtual assistants

Customers can interact with a virtual assistant or chatbot, which can schedule appointments, answer common questions, walk customers through basic processes, set up orders, and look into recent transactions. When AI helps handle these tasks, your team can help a greater number of customers — and generate more sales — in a shorter amount of time.

Additionally, virtual assistants can offer personalized support while allowing customer service team members to focus on more complex work or new customer-facing initiatives and projects.

Automation of repetitive tasks

You know those redundant, tedious tasks that eat up a lot of energy and time? From data entry to reporting and reconciliation, AI can automate repetitive payment processing tasks, which helps streamline and speed up processes while reducing the risk of inaccuracies.

Fraud detection

AI can detect fraudulent transactions in real time.

Customer service and personalization

AI can help schedule appointments, answer customer questions, and personalize the customer journey.

Acceptance rates

AI can identify causes of low acceptance rates and false declines

Data review and insight

AI can analyze customer data and offer insight into customer behaviour.

Source:

Case in point: When it comes to reconciliation, machine learning analyzes large amounts of data, then automatically matches that data to corresponding transactions. Any discrepancies can be flagged for deeper analysis.

How might AI benefit payments?

Now that we've looked at the different ways you can apply AI to the payment processing space, let's go over the overarching benefits of AI in digital payments and at brick-and-mortar establishments.

Fraud detection

AI can help reduce fraudulent payments by detecting unusual transactions in real time. It can also help detect questionable internal behaviour.

For instance, AI can serve as an around-the-clock watchdog by logging in to the banking system after business hours, or when there's a transaction involving a very large amount. AI can also flag transactions with companies and vendors you have no history of doing business with.

Customer service and personalization

Chatbots and virtual assistants can refine and tailor the customer payment journey by analyzing purchase history, browsing behaviour, past interactions, and more.

This AI-driven personalization frees up customer service representatives so they can tackle more challenging requests. It can also help them better understand their customer base, which can lead to better inventory management and greater engagement and satisfaction.

Acceptance rates

AI can find patterns in your payments data and pinpoint anything that could be dragging your acceptance rates down, frustrating your customers, or producing false declines. Tapping into this data means you can boost card acceptance rates and lower transaction fees. Plus, you can bolster card security. All these benefits translate to lower costs for you, which means more resources to put toward scaling your business.

Data review and insight

By analyzing customer data, AI can offer invaluable insight into customer behaviour, which can help you customize and optimize the payment experience.

For instance, AI can help generate an experience that's both more personalized and more convenient for the customer. By looking at a customer's payment history and preferences, AI tools can recommend payment products tailored to location, time, and type of transaction (online, in-person, or phone).

AI can also provide dynamic pricing, which can help you offer sustainable and competitive prices for your goods and services in real time.

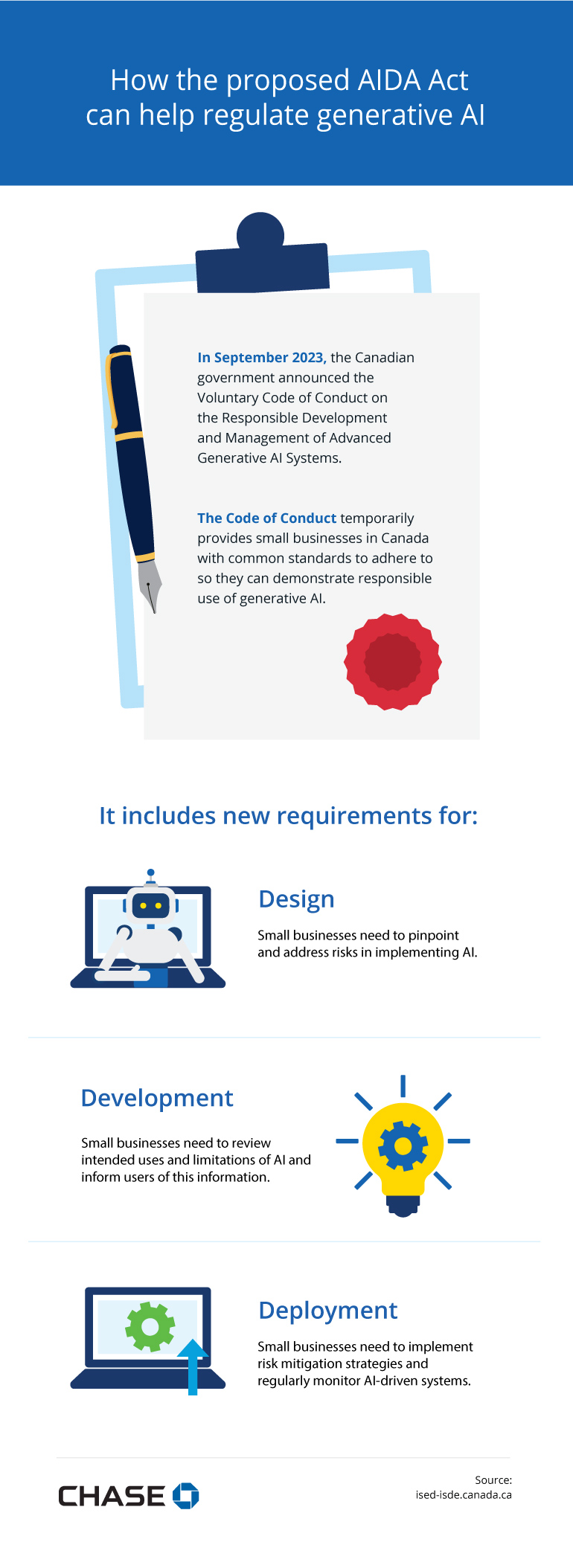

In September 2023, the Canadian government announced the Voluntary Code of Conduct on the Responsible Development and Management of Advanced Generative AI Systems.

The Code of Conduct temporarily provides small businesses in Canada with common standards to adhere to so they can demonstrate responsible use of generative AI.

It includes new requirements for:

- Design

Small businesses need to pinpoint and address risks in implementing AI. - Development

Small businesses need to review intended uses and limitations of AI — and inform users of this information. - Deployment

Small businesses need to implement risk mitigation strategies and regularly monitor AI-driven systems.

Source:

Challenges and considerations

As AI continues to transform the payments space, unknowns about certain tools — and how best to adopt them — will remain. Be mindful of these possible risks and hurdles as you consider AI solutions.

Evolving standards

Canada's Artificial Intelligence and Data Act (AIDA) includes some governance on responsible AI use for businesses, but the act is still evolving. Currently, the Canadian government doesn’t have specific AI regulations for its departments at the provincial or municipal levels.

This lack of oversight and standards across the board can lead to confusion and slow acceptance — not to mention setbacks in the advancement and adoption of AI technology.

Digital literacy gaps

With more than 1 million Canadian small businesses — of varying size, growth stage, and industry — it’s understandable that not all merchants know how to use every AI tool. It takes time to get up to speed with the latest AI technology, adopt new software, and train staff.

Handling sensitive data

With AI tools depending on large data sets, concerns about sensitive financial and customer data are valid. Make sure you understand how your providers store, train, and protect customer data.

Looking ahead as AI matures

AI is no longer the new kid on the block. It’s growing up quickly. From machine learning to predictive analysis, AI has already transformed the payment processing landscape. To remain competitive now and in the future, businesses need to proactively evaluate where — and how — to integrate AI into their strategies and operations. Learn more about AI in retail and AI payment systems in our article hub.