What small business owners need to know about GST, HST, and other taxes

By Jackie Lam

Taxes aren’t the most fun part of business ownership, but if you’re accepting payments for goods and services in Canada, it’s important to understand the national and provincial sales taxes. When you manage payments for your small business, you must comply with Canada’s goods and services tax (GST) regulations.

Getting your head around the ins and outs of tax requirements as a small business owner can feel like an overwhelming affair. Whether you've been in operation for several years or you’re planting the seeds to launch your side business, GST, HST, and PST may look like a merry jumble of alphabet soup.

In this guide, we'll help you decipher what these different tax numbers mean, how they're used, and ideally when and how you should register for these numbers.

Note: The information in this article provides general information for small businesses. We are not tax advisors.

What is a GST number and how is it used?

If you're a small business that is required to collect taxes on your goods and services, you'll need to get a GST number from the Canada Revenue Agency (CRA). GST is short for Goods and Services Tax, and this number serves as registration and identification for your business.

You will use the GST number in the following ways:

- Include it on your invoices to clients to signal that you're required by the Canadian government to collect taxes.

- If your company is structured as a corporation, use it to report your corporate income tax.

- Use it when reporting and remitting payroll deductions for any employees.

When tax season rolls around, you’ll pay the money you've collected for taxes to the CRA. The GST is one of many taxes you'll need to be aware of.

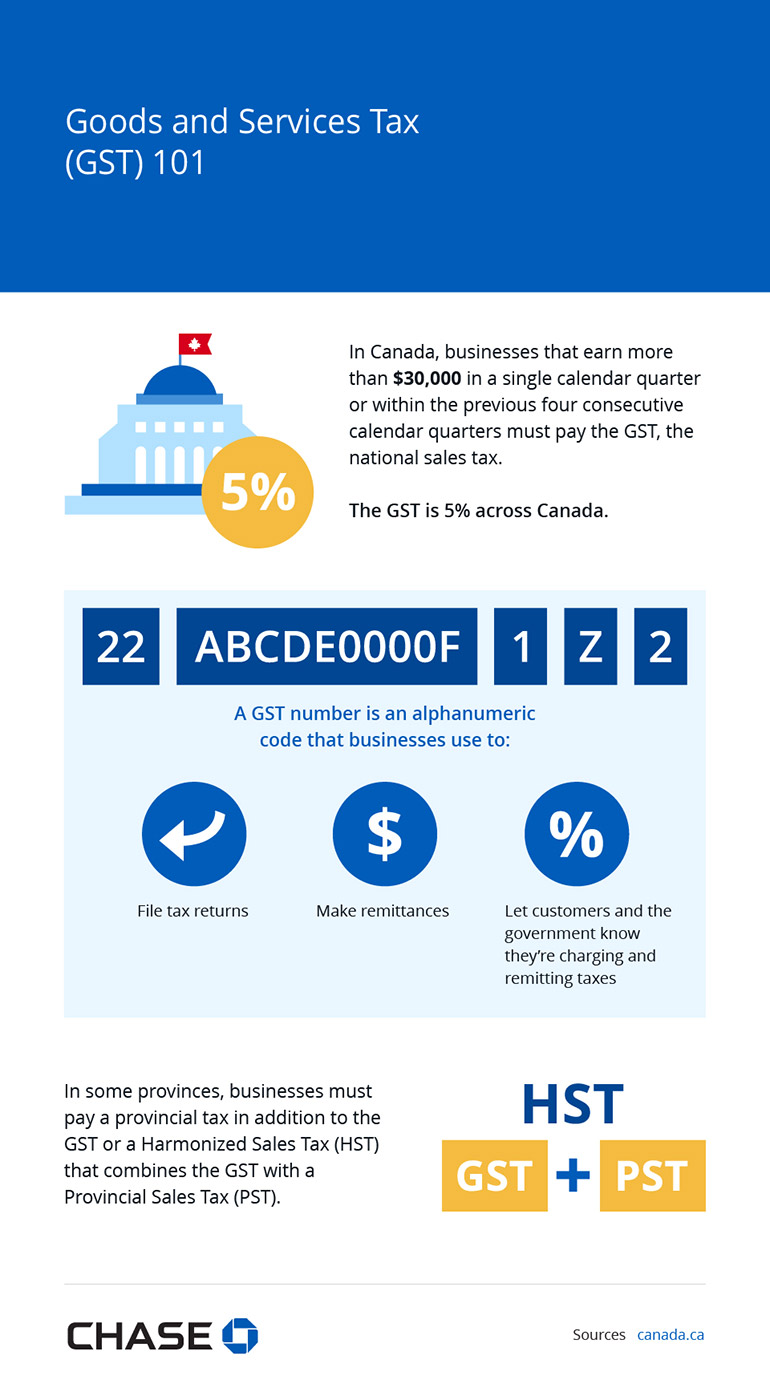

To offer a bit of context, let's go over the GST. Most taxable products and services in all provinces and territories in Canada are currently taxed at a 5% rate.

In Canada, businesses that earn more than $30,000 in a single calendar quarter or within the previous four consecutive calendar quarters must pay the GST, the national sales tax.

The GST is 5% across Canada.

A GST number is an alphanumeric code that businesses use to:

- File tax returns

- Make remittances

- Let customers and the government know they’re charging and remitting taxes

In some provinces, businesses must pay a provincial tax in addition to the GST or a Harmonized Sales Tax (HST) that combines the GST with a Provincial Sales Tax (PST).

Source:

However, in provinces and territories, the GST is combined with the Provincial Sales Tax (PST). This mix of both taxes is known as the Harmonized Sales Tax (HST).

PST

Short for Provincial Sales Tax, this tax is specific to certain provinces. Only four provinces charge PST:

- British Columbia

- Manitoba

- Quebec

- Saskatchewan

PST is another type of tax and is collected separately from the Goods and Services Tax.

What's a little tricky is provincial tax goes by different names according to the province.

- British Columbia and Saskatchewan: Provincial Sales Tax (PST)

- Manitoba: Retail Sales Tax (RST)

- Quebec: Quebec Sales Tax (QST)

HST

Just as a musical harmony combines notes and sounds, Harmonized Sales Tax — or HST — is the combination of the Goods and Sales Tax (GST) and Provincial Sales Tax (PST).

If you're a small business owner operating in these provinces, you collect only one tax, which is the HST:

For example, in Ontario, instead of charging two separate taxes, a GST and PST, you charge an HST, which is currently 13%. In New Brunswick, Newfoundland and Labrador, and Prince Edward Island, the HST is 15%.

Revenu Québec

Revenu Québec is a department that's part of the Government of Quebec. The overarching mission of Revenu Québec is to make sure taxpayers pay their fair share to fund public services in the province.

Here are some of the things they are responsible for:

- Collect income and consumption taxes.

- Administer a handful of public assistance programs.

- Collect taxes for certain government bodies, including GST in Quebec for the Canada Revenue Agency (CRA).

If you operate a small business in Quebec and need to get a GST and QST (remember, Quebec calls their province tax the Quebec Sales Tax), you can do so through Revenu Québec. First, you'll need to register your business.

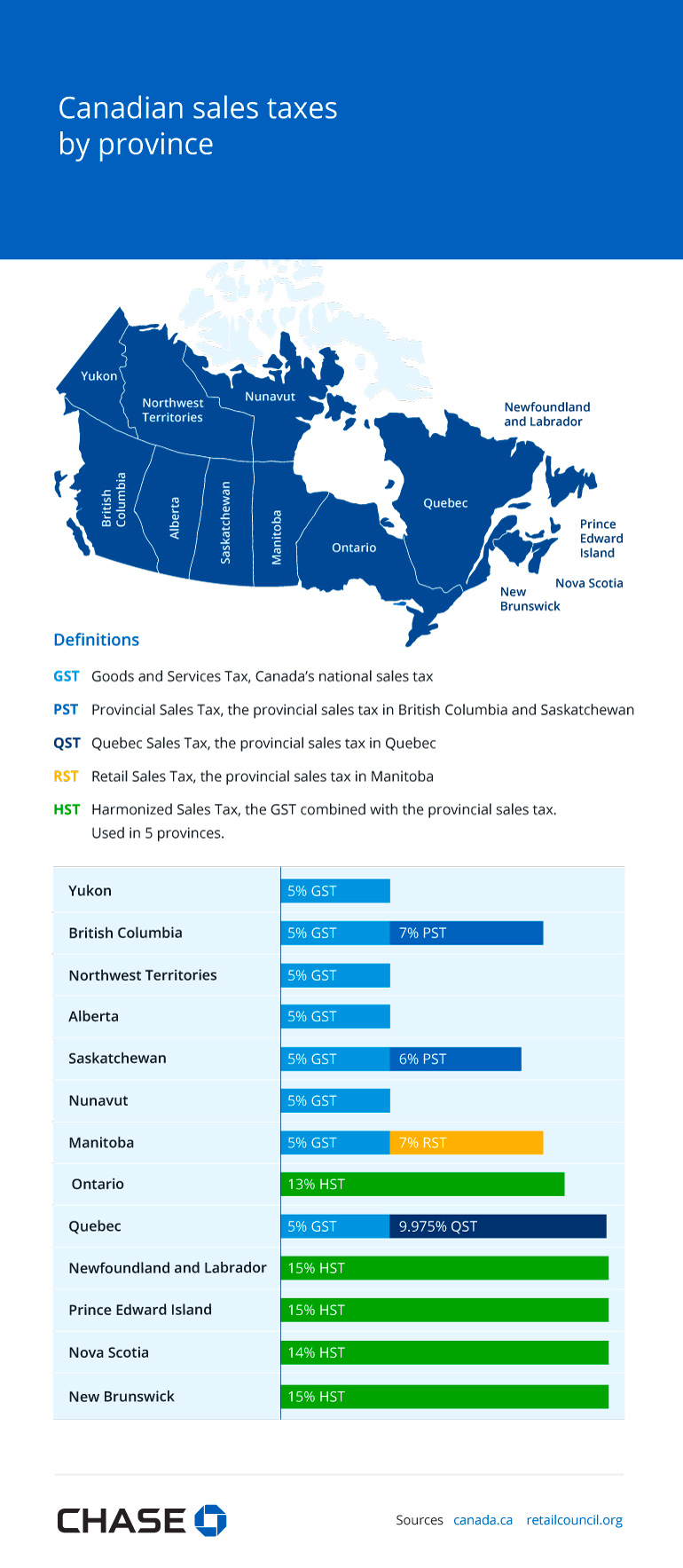

Definitions:

- GST: Goods and Services Tax, Canada’s national sales tax

- PST: Provincial Sales Tax, the provincial sales tax in British Columbia and Saskatchewan

- QST: Quebec Sales Tax, the provincial sales tax in Quebec

- RST: Retail Sales Tax, the provincial sales tax in Manitoba

- HST: Harmonized Sales Tax, the GST combined with the provincial sales tax. Used in 5 provinces.

- Yukon: 5% GST

- British Columbia: 5% GST + 7% PST

- Northwest Territories: 5% GST

- Alberta: 5% GST

- Saskatchewan: 5% GST + 6% PST

- Nunavut: 5% GST

- Manitoba: 5% GST + 7% RST

- Ontario: 13% HST

- Quebec: 5% GST + 9.975% QST

- Newfoundland and Labrador: 15% HST

- Prince Edward Island: 15% HST

- Nova Scotia: 14% HST

- New Brunswick: 15% HST

Sources:

The small supplier rule and exemptions

If you're categorized as a small supplier, the Small Supplier Rule applies to you in certain provinces, and you may not be required by the CRA to register for a GST number and collect taxes.

In general, to qualify as a small supplier, your revenue from worldwide taxable supplies cannot exceed $30,000 (or $50,000 for public service bodies) in a single calendar quarter and within the previous four consecutive calendar quarters.

Keep in mind that this definition stipulates gross revenue, not profit. Plus, if your company operates in a province where businesses are required to pay a provincial tax and you qualify as a small supplier, you're still responsible for collecting, reporting, and paying provincial taxes.

What if you're a small supplier and opt to get a GST/HST number? In that case, you'll be required to charge taxes, collect taxes, and report on your taxable supplies of services and properties.

So, is it ever worth it to get a GST or HST number even though you qualify as a small supplier and you technically aren't required to get it?

It may be. For instance, you may prefer that your clients and vendors don’t know that you're a "small supplier" so they don’t infer that you earn less than $30,000 in quarterly gross revenue.

Additional exemptions

A handful of services are exempt from the GST or HST. These services include:

- Legal aid services

- Many educational services

- Music lessons

- Most services provided by financial institutions

- Long-term residential rentals

- Childcare services

Zero-rated supplies

These supplies are taxed at a GST/HST rate of zero. So why give them a tax percentage at all if they're not taxed?

Here's the kicker: While you don't charge taxes on these supplies, you can claim input tax credits (ITCs) for the GST/HST paid on property and services acquired to provide these supplies.

Examples of zero-rated supplies include:

- Basic groceries, such as milk and bread

- Most farm livestock

- Feminine hygiene products

- Most fishery products

- Prescription drugs

Some services are exempt from the GST or HST.

- Legal aid services

- Many educational services

- Music lessons

- Most services provided by financial institutions

- Long-term residential rentals

- Childcare services

Some goods are taxed at 0% across the country.

- Basic groceries

- Agricultural products

- Fishery products

- Prescription drugs and some medical devices

- Feminine hygiene products

- Exports

Sources:

Steps for registering for a GST number

You can register for a GST/HST number over the phone or online through the CRA's Business Registration Online (BRO).

First, you'll need to register for a business number. Once you've secured one, here's the information you need to get a GST number:

- Effective date of registration

- Fiscal year for your GST/HST

- Total revenue

- Personal information (e.g., names of business owners, personal postal code, Social Insurance Number [SIN])

- Business information (e.g., business name, type of business structure, type of business, physical address)

You'll need to start charging GST/HST on your taxable supplies on the date your registration is effective.

How often you'll need to report depends on your yearly total revenue on taxable supplies:

- $1.5 million or less: annually

- More than $1.5 million and up to $6 million: quarterly

- More than $6 million: monthly

Closing a GST/HST account

If you'd like to close your GST/HST account, you'll need to provide the following:

- Business number

- Legal name of your business

- Date of cancellation

- Reason for closing your account

Move your business forward

GST numbers may seem perplexing at first glance. It’s important to understand what they are, how they're used, and when you’re required to register for a number and collect taxes to ensure you're structuring your sales correctly and staying on top of your tax liabilities.

GST numbers are only one thing you’ll need to think about when you accept payments for goods and services. To learn more about starting a business, you can read our articles about accounting and bookkeeping basics and how to register a business.