How omnichannel payments benefit businesses

By Danielle Antosz

Omnichannel payments may sound like a buzzword, but it's becoming increasingly important to offer consumers the ability to connect their online and in-person shopping experiences. Consumers spend more time online than ever before; more than 90% of Canadians have access to high-speed Internet, and one quarter of Canadians spend 20 hours per week using the Internet for general purposes.

So what exactly are omnichannel payments, and how do you find the right payment provider? Here’s what you need to know to achieve success across different channels.

What are omnichannel payments?

Omnichannel payments are an integrated payment solution that allows customers to seamlessly make payments through multiple channels, including online, in-store, and at events. Take, for example, a coffee shop where customers can order and pay for their drinks both in-store and through a mobile app.

While omnichannel payments involve offering multiple payment options, they differ from multichannel payments in several key areas. Businesses that offer multichannel payments allow consumers to pay with multiple payment methods, such as credit card and debit card, digital wallet, and buy now, pay later (BNPL).

Businesses that offer omnichannel payments, on the other hand, support payment options that work together both online and in person. For example, imagine a customer trying on dresses at their favourite clothing store. A staff member helps them choose the perfect shoes, but the store doesn't have the right size in stock. The clerk uses a handheld device to order the correct size from their online store, ship the shoes to the customer's home, and accept payment all at once. That’s the power of omnichannel payments.

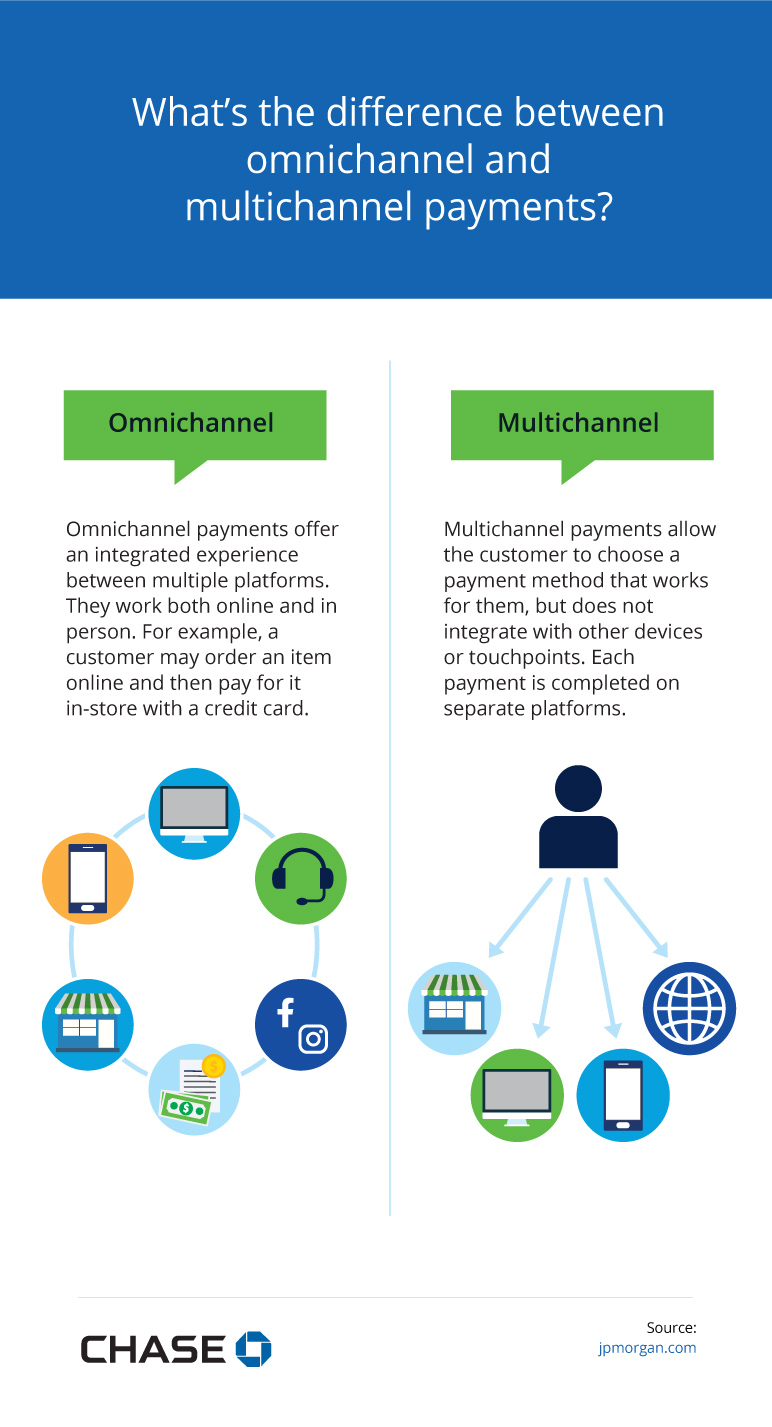

Omnichannel

Omnichannel payments offer an integrated experience between multiple platforms. They work both online and in person. For example, a customer may order an item online and then pay for it in-store with a credit card.

Multichannel

Multichannel payments allow the customer to choose a payment method that works for them, but does not integrate with other devices or touchpoints. Each payment is completed on separate platforms.

Source:

Omnichannel payment examples

Omnichannel payment systems provide customers with multiple payment options, including:

- In-person payments

- Credit cards

- Debit cards

- Mobile wallet

- Online payments

- Credit cards

- Debit cards

- Automatic funds transfer (AFT)

- Electronic funds transfer (EFT)

- Mobile wallet

- In-app or in-browser payments

The true power of omnichannel payments is how all those methods can work together. A simple example is a parking meter that accepts payment in coins at the meter or through an online portal accessed via a QR code.

In-store scanning systems are another excellent example of omnichannel payments in action. Using their phones, customers at certain stores can use a mobile app to scan items as they shop. Once they complete their shopping, they can check out through the app, avoiding long lines at the register. Many store apps offer additional features like online ordering for home delivery or in-store pickup, allowing customers to switch between channels seamlessly.

Omnichannel customer journey examples

Omnichannel payments facilitate several different customer journeys across multiple channels and at different touchpoints before, during, and after shopping. These journeys include:

- Buy online, pick up in-store

The customer completes their purchase online and picks up their order in-store. - Reserve online, pay and pick up in-store

The customer reserves a product online and then pays for and picks it up in-store. - Scan and pay (also called scan to pay)

The customer scans a QR code to complete a payment without the need to enter merchant details. - Buy in app during visit

The customer orders an in-stock item via the merchant’s mobile app while in-store. - Pay by link

The customer pays by clicking a link sent via email or text. - Endless aisle

The customer can purchase from a merchant’s entire inventory — via a tablet or kiosk, for instance — while viewing a smaller sample of products in-store. - Delivery subscription

The customer provides their payment information online or in-store and agrees to recurring deliveries. - Buy online, return in-store

The customer returns an online purchase in-store.

How omnichannel payments benefit customers and businesses

Omnichannel payments are all about convenience — for both customers and companies. Forcing customers to switch between multiple apps during the purchase process creates friction, which can reduce conversions. By streamlining the payment process with omnichannel payments, companies can improve the customer experience in a simple but effective way.

Omnichannel payments do more than improve the bottom line. Let's explore the benefits in more detail.

- Better customer engagement

Omnichannel payments make it easier to offer personalization across channels. A customer who makes an in-store purchase, for example, can receive related product suggestions while shopping online. - Increased customer loyalty

By allowing customers to seamlessly transition between online and offline channels, businesses provide a smoother purchasing experience, which can increase customer loyalty. - Lower customer churn

With omnichannel payments, customers can easily order online while in-store if they can’t find the specific item they’re looking for. Plus, they can continue a digital shopping experience on a different device once they’re home. By decreasing friction in the payment process, businesses can reduce the likelihood of losing sales to a competitor. - Better customer data

By connecting online and in-person purchases, businesses gain deeper insight into their customers’ preferences. They can use this data to improve marketing and personalization efforts.

Customers

- Less payment friction

Customers can complete purchases without switching between multiple apps. - Seamless payment options

Customers can seamlessly transition between online and offline channels. - Better user experience

Customers benefit from a more personalized shopping experience.

Businesses

- Improved conversion rates

Businesses can boost conversion rates by reducing friction along the customer journey. - Lower churn rate

Businesses can reduce the likelihood of losing sales by facilitating easy transitions from in-store to digital purchases and from device to device. - Improved customer loyalty

Businesses can foster long-lasting relationships with their customers by offering a smoother purchasing experience. - More accurate customer data

Businesses can gain a deeper insight into their customers’ preferences by connecting online and in-person purchases.

Source:

Are omnichannel payments right for your business?

An omnichannel payment strategy is a smart choice for businesses that offer online and offline sales. By taking strategic steps to improve the customer experience, businesses increase their chances for conversion and brand loyalty — an especially important factor for businesses looking to compete with well-known brands.

Imagine a clothing brand with both online and brick-and-mortar locations. A customer visits the store's website on their computer and adds several items to their digital cart. Before they complete the purchase, they realize they need to head to work. With an omnichannel payment strategy, the customer can seamlessly transition from the desktop browsing session to the mobile shopping experience without needing to abandon the purchase. Once at the office, the customer logs in to their account from their smartphone to find the items they added to their cart synced and ready for checkout. The customer continues their shopping experience, then selects their preferred payment method and finalizes the transaction.

Customers are already enjoying these types of experiences with many of their favourite brands, and smaller businesses can offer the same experience. With smooth transitions between devices and locations, you can expect cart abandonment to decrease and customer satisfaction to increase.

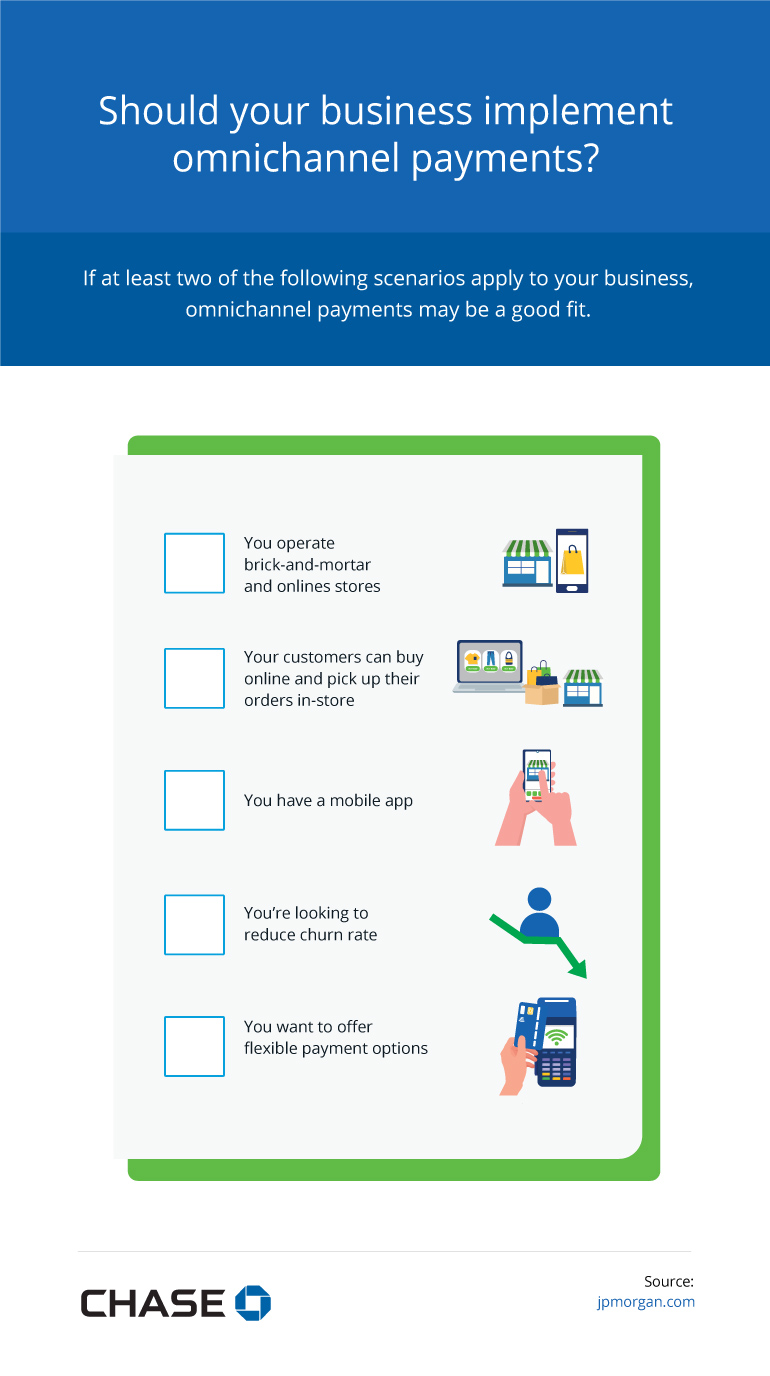

If at least two of the following scenarios apply to your business, omnichannel payments may be a good fit.

- You operate brick-and-mortar and online stores

- Your customers can buy online and pick up their orders in-store

- You have a mobile app

- You’re looking to reduce churn rate

- You want to offer flexible payment options

Source:

Choosing an omnichannel payment solution

Selecting the right omnichannel payment solutions is the key to building a successful program. So what features and factors should you consider when comparing prospective payment processing partners?

- Support for the right channels

The right solution must support and connect the channels your customers use. Depending on your needs, you may look for a provider that can integrate mobile apps, in-store shopping, BNPL, social media, and more. - Reliability

Trustworthiness is crucial to maintaining customer trust and preventing disruptions. Choose a partner with a track record of secure payment processing, minimal downtime, and consistent transaction speeds. - Scalability

As your business grows, you need a payments partner who can scale its services accordingly. Scalability includes accommodating increased transaction volumes, expanding into new markets, and supporting additional features or integrations.

Adopting an omnichannel payments program

Building an omnichannel payment program is ideal for businesses looking to improve the customer experience and customer engagement while reducing churn. The key to competing in today's digital world is choosing the right omnichannel payment processing partner to fit your business needs today and as you grow.